The dollar traded near its lowest levels of this year. Everyone expects the start of the US easing cycle, and many are betting on a big cut.

The Euro jumped to $1.1138 on Monday, which is only a step from this year’s high.

Fed funds futures rallied on Monday to push the chance of a 50 basis point rate cut to 67%, against 30% a week ago.

“Regardless of which of -25bps or -50bps the (Fed) goes with on Wednesday, we do think that the Fed’s messaging will be ‘dovish,'” said Macquarie strategist in a note to clients.

Anyway, the USD can fall big if the decision will be a -50bps cut, but the -25bps also can push it lower.

We have to wait a little more to know the decision of the 4XGODZ about the dollar’s journey, but you can see that the market prepared for the rate cut, so this is what I think about tomorrow.

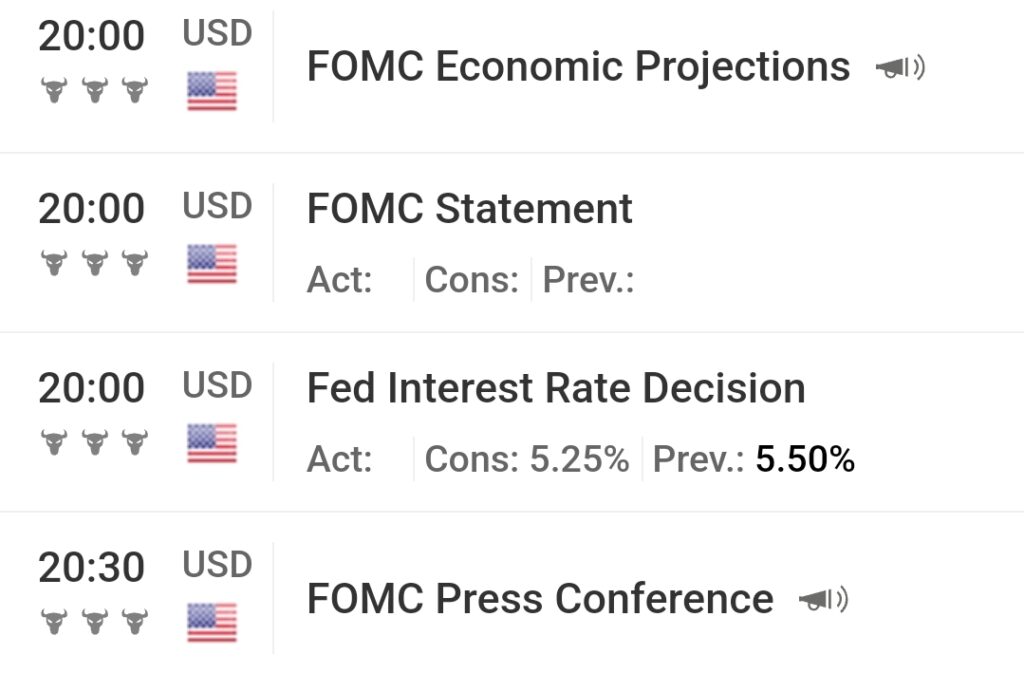

I bet for a -25bps rate cut because the -50 looks too wild, and probably, the Fed doesn’t want a too-weak dollar now. It would cause much more problems. I think the USD will jump up and down for a while after the decision and we will see the clear way only after the Press Conference. I suggest not trading near the Interest Rate Decision only if you are an experienced news trader.